tax credit survey ey

As we previously reported EY Tax Alert 2020-1199 the IRS has now released a draft Form 941 and instructions that starting with the 2020 second quarter provide the details necessary for. 2 The tax credit benefit can range from 2400 to 9600 depending upon the employees category of eligibility.

Millennial Economic Innovation Group

Upload any documents needed to complete this task.

. Multinational organizations need access to real-time global data that offers clear insights into opportunities obligations and risks. Perfect answer A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you. 2 The tax credit benefit can range from 2400 to 9600 depending upon the employees category of eligibility.

Tax and Finance Operations Survey EY - Global Back Back Back How transformations with humans at the center can double your success 24 Jun 2022. Take WOTC survey. Tax credit survey eyTheyre asking for my ssn for a tax credit surveyAmong the attendees at the EY 36 th Annual International Tax Conference the 355 survey respondents represent senior.

Nov 19 2020 The IRS WOTC form says you can claim 26 percent of first year wages for an employee who puts in 400 hours or more during the tax year. The survey results are available for download in the attached PDF file. Perfect answer What Is Tax Credit Survey.

The tax survey is complete. EY Global Tax Platform. You may need to download and electronically sign forms as part of this task.

The EY Global Tax Platform GTP. As we reported in our previous alert EY Tax Alert 2020-2163 the IRS provided the following details in. EY has published a new survey as part of its Future of VAT project.

Complete WOTC survey process record confirmation number. Take the survey answering questions as needed. This is the Ernst Youngs vendor survey site.

Click Take Survey to answer the questions and follow the prompts until. Filmywap hd movie hub alternate duty location air force marmot 3person tent. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Ceos Shift Focus To Sustainability And Digital Transformation Ey Survey Business Standard News

2022 Ey Guide To Salary Levels Pay Scale Compensation

Work Opportunity Tax Credit What Is Wotc Adp

Ey To Split Accounting And Consulting Businesses The New York Times

Ceos Shift Focus To Sustainability And Digital Transformation Ey Survey Business Standard News

Former Ey Auditor Charged With Insider Trading Cfo

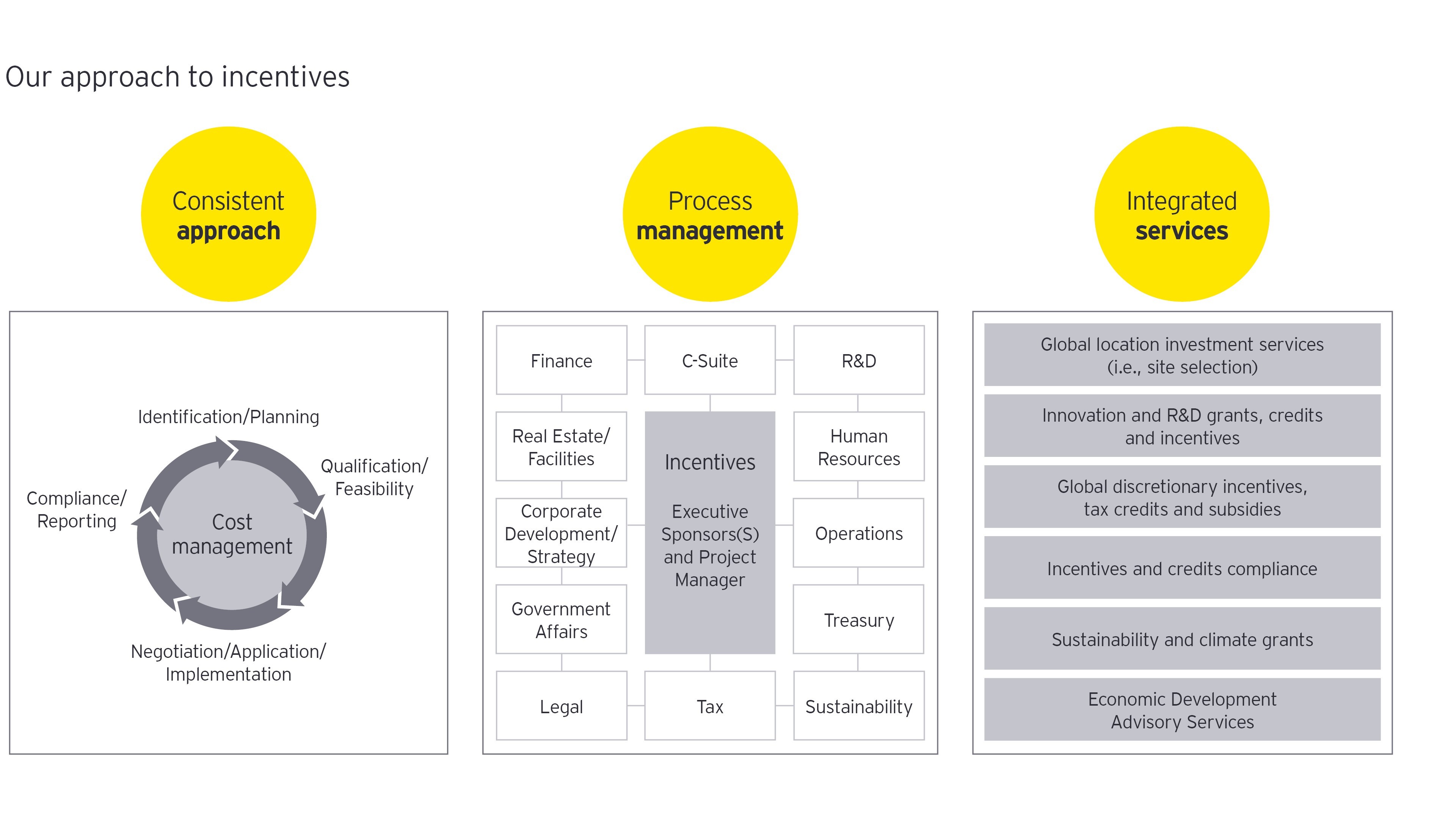

Global Incentives Innovation And Location Services Giils Ey Us

How Executives Are Capturing Federal Business Tax Credits Ey Us

Millennial Economic Innovation Group

Airinc Workforce Globalization Helping Clients Deploy Talent Worldwide

Global Location Investment Credit And Incentives Services Ey Us

Kathryn Holland Partner Tax Ey Linkedin

Worldwide R D Incentives Reference Guide 2022 Ey Global

Webcast 2021 Employment Tax Year In Review Ey Us

Realizing The Value Of Your Tax And Finance Function Ey Global

Marna Ricker Marnaricker Twitter

Ey Taxchat Review 2022 Convenient Professional Level Tax Prep